Introduction

Insurance groups have to process a large number of damaged vehicle files in a very short space of time. Modern technologies such as AI can help these insurance groups process these files faster, more efficiently and with greater accuracy. Let's find out how.

The main applications of AI for insurance.

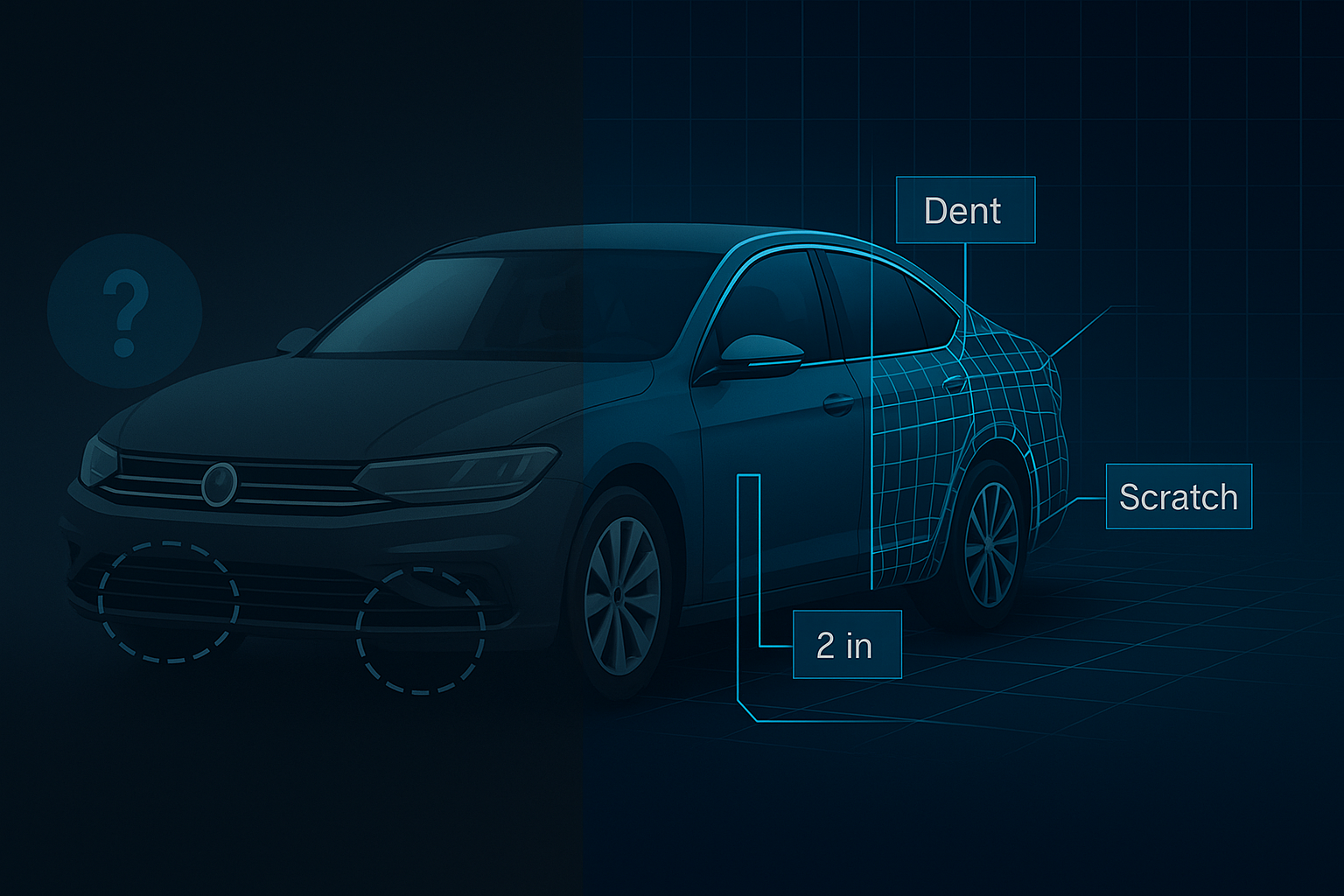

The main applications of AI in the processing of damaged vehicle files are image analysis and damage recognition. Insurance groups can use AI to analyze images of damaged vehicles and determine for each damage: its type, its depth, its severity, whether it's a scratch or a dent. This analysis can be carried out automatically, and can help to establish a more accurate and rapid estimate of repair costs.

Artificial intelligence (AI) can be an extremely useful tool for insurance groups dealing with a large number of vehicle files with bodywork damage. Modern AI technologies can help insurance groups process these files faster, more efficiently and with greater accuracy, enabling deeper analysis and more informed decisions.

How does it work?

Using machine learning algorithms, AI can identify the most common types of damage and classify them by location, type and severity. It then helps insurance groups identify the most urgent or complex cases, so that they can be dealt with as a priority. It also saves them time across the board.

AI for insurance: what uses?

In the case of simpler files, AI can then help claim reps to optimize the handling process. The simplest tasks, such as damage recognition, can be fully automated. In this way, the expert can concentrate on assessing the damage and the impact this has on the value of the vehicle.

Here, AI can be used to improve the quality and consistency of damage assessments. AI algorithms can learn from large amounts of data and identify recurring patterns, which can help improve the accuracy of repair cost estimates and vehicle value assessments.

AI, a real asset for insurance groups.

Yes, the use of AI can help insurance groups deal more effectively with vehicle files with body damage. Applications of AI in this damage include image analysis, damage recognition, and improving the quality and consistency of damage assessments. By using these technologies, insurance groups can work more efficiently, process more cases and provide more accurate and faster services to their customers. This is the case, for example, with ALTO AI, Tchek's AI accessible via API, which has the capacity to process a large number of images in a short space of time to identify damage, its location, type and severity. And issue a detailed report including repair costs.